The wine sector finds the agreement between the European Union and the United States on the new 15% tariffs for Italian wine exports, effective August 1, insufficient, but at the same time awaits the final text for an overall assessment of the agreement.

In particular, Frescobaldi, president of the Uiv (Italian Wine Union), states: “With the 15% tariffs, the glass will remain half empty for at least 80% of Italian wine. We estimate the damage to our companies to be around 317 million euros accumulated over the next 12 months, while for our trading partners overseas, the lost earnings could rise to nearly 1.7 billion dollars. The damage would increase to 460 million euros if the dollar maintains its current devaluation level. We are calling on the Italian government and the EU to consider appropriate measures to safeguard a sector that has grown significantly thanks to the American buyer.”

He adds: “With today’s meeting in Scotland between Presidents Trump and Von der Leyen, we have at least stepped out of the uncertainty that was stagnating the market; now, it will be necessary to take on the lost revenue along the supply chain to minimize shelf markups.

According to our analysis, at the beginning of the year, the Italian bottle that left the winery at 5 euros was sold at 11.5 dollars; now, between tariffs and the devaluation of the U.S. currency, the price of the same bottle would be close to 15 dollars. This means that if the final price previously increased by 123% in relation to the ex-warehouse value, it will now rise to 186%.”

For the Uiv Observatory, the cost is much higher for the restaurant sector, where the same bottle at 5 euros risks costing about 60 dollars at the table – with a normal markup.

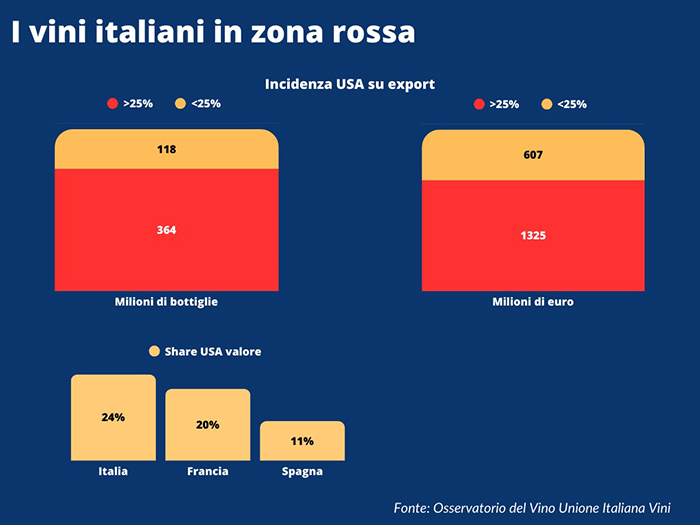

“We cannot be satisfied with this agreement,” said Paolo Castelletti, the general secretary of the Italian Wine Union. “A 15% tariff is certainly lower than the proposed 30%, but it is equally true that this rate is enormously higher than the almost nonexistent pre-tariff rate. Compared to European competitors, Italy also risks experiencing a greater impact, partly due to its higher net exposure in the U.S. market, which accounts for 24% of the total export value compared to 20% for France and 11% for Spain; and partly because of the types of products from our country that focus on quality-price ratio, with 80% of the product concentrated in the ‘popular’ ranges – so, at an ex-warehouse price of 4.2 euros per liter – with only 2% of Italian bottles falling into the super-premium category.”

“We cannot be satisfied with this agreement,” said Paolo Castelletti, the general secretary of the Italian Wine Union. “A 15% tariff is certainly lower than the proposed 30%, but it is equally true that this rate is enormously higher than the almost nonexistent pre-tariff rate. Compared to European competitors, Italy also risks experiencing a greater impact, partly due to its higher net exposure in the U.S. market, which accounts for 24% of the total export value compared to 20% for France and 11% for Spain; and partly because of the types of products from our country that focus on quality-price ratio, with 80% of the product concentrated in the ‘popular’ ranges – so, at an ex-warehouse price of 4.2 euros per liter – with only 2% of Italian bottles falling into the super-premium category.”

According to the Uiv Observatory, the risk – if revenue reductions along the supply chain are not activated, which still represents a loss – is that by the end of 2026, we will find ourselves close to the values expressed in 2019.

For Uiv, as much as 76% (equivalent to 366 million bottles) of the 482 million Italian bottles shipped last year to the United States are in the “red zone,” with exposure on total shipments exceeding 20%.

Wine regions showing the highest peaks include Moscato d’Asti (60%), Pinot Grigio (48%), Chianti Classico (46%), Tuscan red DOP at 35%, Piedmont reds at 31%, as well as Brunello di Montalcino, finishing with Prosecco at 27% and Lambrusco. In total, this amounts to 364 million bottles, valued at over 1.3 billion euros, which is 70% of Italian exports to the United States.

Brunello di Montalcino wine consortium

Giacomo Bartolommei, president of the Brunello di Montalcino wine consortium, comments: “The 15% tariffs will severely impact Brunello di Montalcino, the main symbol of Italian wine in the United States, and will put the resilience of companies to the test. While we wait to know the list of zero-tariff products, it’s clear that the implementation of these tariffs will lead to a slowdown in exports to our primary destination.”

He continues: “The American market accounts for 30% of our exports, equivalent to over 3 million bottles; in this scenario, it will be difficult, if not impossible, to reallocate unsold stock in the short term to other markets. Therefore, it is essential to proceed quickly with new trade negotiations, starting with Mercosur, to open new routes.

The Brunello di Montalcino Consortium – the president concludes – will continue to monitor the U.S. market. In fact, we have already confirmed all the events for 2026, such as the Benvenuto Brunello in New York and participation in Food & Wine in Aspen, one of the most important industry festivals in the U.S. At the same time, we are preparing a strengthened promotional plan in Asia.”